Cheap Car Insurance in the UK (2026)

Car insurance is an obligatory law in the UK and with the premiums increasing, and dozens of insurance companies, it can be confusing to find the best car insurance in the UK. It can be a new driver, a change of car insurance, or just to find the cheapest car insurance, this ultimate guide will be able to help you compare, learn about the different types of coverage, and get the best rate.

This article should prepare to answer the most popular questions asked on car insurance UK, to make the right decision and in a way to save hundreds of pounds annually.

What is Car Insurance and Why Do You need it in the UK?

Car insurance covers you in case of financial losses in case your car is the subject of an accident, stolen, damaged or causes any harm to other people. In the UK, any person who commits the crime of driving without third party car insurance is illegal.

Lack of having valid insurance may lead to:

- Unlimited fines

- Penalty points

- Vehicle seizure

- Driving disqualification.

That is why the search best car insurance UK or car insurance quotes UK can be discussed as one of the most frequent insurance-related Google search.

Types of Car Insurance in the UK

It is necessary to learn the types of policy before comparing car insurance quotes.

1. Third Party Only (TPO)

This is the minimum legal provision.

- Covers include damages to other vehicles and property.

- Protects the injuries of other individuals.

- Does not cover your own car.

Best for: Arguably the best when it comes to older cars or drivers who need basic coverage (not necessarily the most affordable).

2. Third Party, Fire and Theft (TPFT).

Includes:

- Third-party cover.

- Cover in the event that your vehicle is stolen.

- Insuring against car damages by fire.

Best for: Drivers who seek a bit more coverage at a reduced rate, that is, not comprehensive insurance.

3. Comprehensive Car Insurance

The most trending within the UK.

- Protects your car and the vehicle of others.

- Includes fire, covers, vandalism and weather damage.

- Usually has additional extras such as windscreen cover.

Best for: This is best suited to most drivers who need the assurance of the car and often have better value than third party policies.

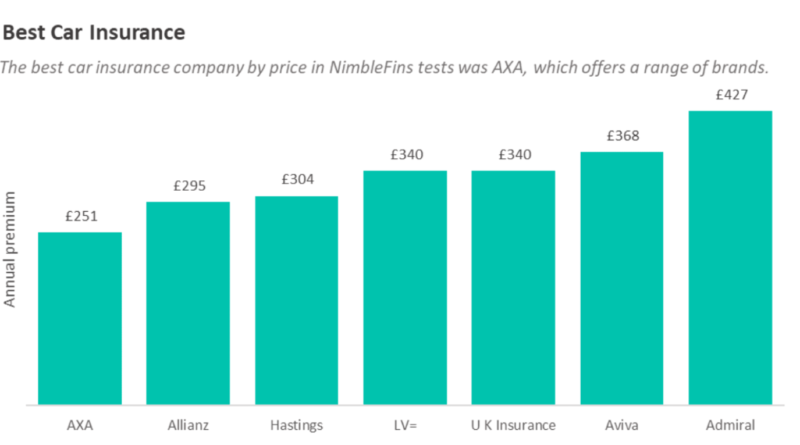

Best UK car insurance firms (2026)

Whenever individuals seek the best car insurance providers in UK, they often desire a compromise in price, coverage and customer service. The following are some of the most reputable and popular providers:

1. Admiral

- Competitive multi-car insurance reputed.

- Good customer satisfaction.

- Flexible policy options.

2. Aviva

- One of the largest insurers in the UK.

- Excellent claims handling.

- Added coverage such as breakdown cover.

3. Direct Line

- Not included on comparison websites.

- Good reputation of customer services.

- Good to the mature drivers.

4. LV= (Liverpool Victoria)

- Rated very highly on claims service.

- Competitive comprehensive-policies.

5. Hastings Direct

- Popular because of low cost car insurance.

- Appropriate among young and risky drivers.

Advice: When buying car insurance, you should always make comparisons of the quotes with the different companies and not picking the first company you encounter.

Comparison of Car Insurance Quotes in UK.

What Does Affect Car Insurance Quotes?

- Age and driving experience.

- Location and postcode.

- Type of vehicle.

- Annual mileage.

- No Claims Discount (NCD)

- Job title.

- Voluntary excess.

Your premium can be impacted even by slight variations, this is why it is necessary to compare quotes.

Cheapest Car Insurance in the UK: How to Save Money

Finding low cost car insurance UK does not imply compromising. Use these proven strategies:

Compare Quotes Regularly

Always remember to check alternatives before renewing. Customers that are loyal usually pay higher.

Maximize Your Excess Voluntarily.

The amount of excess you have can greatly lower your premium, but make sure that it is affordable in case you have to claim.

Telematics (Black Box Insurance) Usage.

Ideal for young drivers. Lower costs are achieved through safe practices of driving.

Limit Optional Add-Ons

Only few extras you cannot do without like breakdown cover or legal cover.

Park Securely

Covering your car in a garage or driveway will save on your insurance premium.

Top Car Insurance Company for Young Drivers in the UK.

Premiums can be the highest on young drivers. Nevertheless, there are insurers that focus on low-cost.

Tips for Young Drivers:

- Select cars that have low insurance group ratings.

- add a professional named driver.

- Take black box car insurance.

- Avoid modifications

Seeking the best car insurance to young drivers UK usually results in huge saving once the following steps are implemented.

The Short-Term and Temporary Car Insurance in UK.

When would Temporary Car Insurance come in?

- Borrowing a car.

- Test driving a vehicle.

- Short-term travel.

- Sharing a car.

The coverage duration may be as short as 1 hour to 30 days and is usually much less expensive than annual coverage.

Electric and Hybrid Car Insurance in UK.

As the rate of EV adoption increases, the coverage of electric car insurance UK has also gained popularity.

Key considerations:

- Battery replacement cover

- Charging cable insurance

- Specialist repair networks

Certain insurers currently provide reduced EV policies, and therefore, it is always important to indicate the type of car when making comparison of quotes.

Add-ons to Common Car Insurance

The knowledge of add-ons will assist you in saving on unnecessary expenditures.

Add-On Is It Worth It?

| Add-On | Is It Worth It? |

|---|---|

| Breakdown Cover | Yes for frequent drivers |

| Legal Expenses | Useful for non-fault claims |

| Courtesy Car | Helpful but often limited |

| Windscreen Cover | Usually worth it |

| Personal Accident Cover | Optional |

No Claims Discount (NCD): How does it work?

Up to 65% of your premiums could be saved in No Claims Discount in the long term.

- Typically obtained following 1 year without claims.

- Protectable at additional expense.

- Frequently movable between insurers.

Whenever you are changing, ensure that your NCD is recognised.

Is Comprehensive Insurance more cost effective than the Third Party?

Surprisingly, yes – often it is.

Since complete policies would attract better drivers, insurers tend to offer them lower costs when compared with third-party insurance. Always consider the two before you make a decision.

When to purchase car insurance in the UK?

Research indicates that when purchasing insurance 21-26 days of your renewal date the quotes are usually the lowest. Purchases that are made on a last-minute basis are likely to be costly.

Conclusions: Which Is the best automobile insurance in the UK?

The most suitable car insurance UK policy will rely on your:

- Driving history

- Budget

- Car type

- Coverage needs

There is no one single best insurer to all people- but with a comparison of the quotes, awareness on the cover, and no more needless add-ons, you will be able to get a plan that provides itself with a great value and cover.

Key Takeaway

- You should always compare a car insurance quote.

- Broad based insurance tends to be more economical.

- Black box policies can save the money of young drivers.

Final Thoughts

The best car insurance in the UK is not necessarily the most popular car insurance company but rather one that suits your individual requirements as well as your budget and the way you drive. As the car insurance premiums keep on increasing, it is only worthwhile to take time to shop car insurance quotes, learn the coverage and read the policy terms.

All round availability Comprehensive car insurance may be a better deal than third-party cover, and young and risky drivers can save by making clever decisions, such as telematics policies, lower-insurance-group cars, and early renewals. It is up to you when you are looking to find cheap car insurance, change providers or get a new cover to purchase, being informed leaves you in charge.

In conclusion, it is better to check various insurers, do not purchase additional services you do not need, and check your policy once every year. In so doing, you are able to obtain a trusty safeguard, tranquility of mind and the most optimal price on your car insurance in the UK.

Disclaimer

The material of the article is to be considered as general information only and not as a financial, insurance or legal advice. The providers have different car insurance policies, cover plans, costs and qualification criteria, which may also vary with time.

One should always read the entire policy documentations and terms and conditions of any purchased insurance product. Another point that you should put into consideration is to consult a professional insurance adviser or the insurance company itself and make sure that the policy suits you as an individual. We make no assurance to the accuracy, completeness, or appropriateness of the information to your special situation.

Pingback: Liverpool Sydney: Complete Travel, Accommodation & Transport Guide – The World Point