Mariner Finance: A Complete 2026 Review

In the modern economy, personal lending companies have become the preferred choice because most people resort to this option whenever they face some unplanned costs. Among the companies that regularly feature in the search and discussion forums of borrowers are Mariner Finance – a consumer lender and a provider of personal and secured loans. This full analysis excavates all the information you might require on Mariner Finance in 2026: the good, the bad, and the things that you should consider keenly before applying.

It may be that you need to compare personal loans or are seeking ways to improve a poor credit score, or you just need a loan product, this article will lay everything out, including rates, loan products, reviews, eligibility, legal concerns and alternatives. We intend on providing you with a full, truthful and SEO friendly resource in making an informed decision when it comes to borrowing.

What Is Mariner Finance?

Mariner Finance is a consumer finance firm that deals with personal and secured loans to the common customer. People with fair, poor, or limited credit histories who would otherwise not qualify at other traditional banks are usually attracted to Mariner because of the credit scores they have.

Secured and unsecured personal loans of flexible terms and various use-cases including debt consolidation, auto financing, home improvements, emergencies, etc. are offered by the company.

History & Company Overview

Mariner Finance began as a branch-based lender, and over decades, it expanded in the number of loan services it gives to borrowers in various states in the United States. Although it has a physical presence in terms of branch locations, it supports online applications, electronic loan management and mobile service.

Mariner is not available in every state of the U.S., even though it has extended across the country. The location of licenses and operating rights differs.

How Mariner Finance Works?

In the most basic terms, Mariner Finance is an intermediary between its lending capital and individual borrowers who are seeking funding. The company is making profits off interest (APR), origination fees and other interest charges related to the loan agreements.

Borrowers can apply:

- Online

- In-person at a local branch

- Via pre-approved deals sent to them.

Upon approval, the funds go to the borrower directly into his bank account or by a check.

Mariner Finance Loan Products Explained

Mariner Finance provides various kinds of loans products to meet the different financial requirements:

Personal Loans

- Unsecured loans without collaterals.

- The sums of money usually vary between 1,000 and 25,000.

- Loan conditions of 12-60 months.

- Usually taken into consideration by people whose credit history is low or bad.

Secured Loans

- Secured loans- usually a car or other property.

- The cost of May is lower since there is less lender risk.

Cosigner Loans

- In case your credit is low, a cosigner can be of help in getting approved or reducing your interest rate.

Loan-by-Mail Check Offers

Mariner occasionally makes live check offers via mail. In case cashing or depositing of this check, then you are engaging in a loan agreement. Caution is necessary because such loans that are generated in this manner may have unfavourable conditions unless they are completely comprehended.

Mariner Finance Rates & Fees (APR, Terms & Requirements)

Cost is one of the most important considerations by borrowers. Here’s what you should know:

Interest Rates (APR)

- Typically range from 16.00% to 35.99% APR

- The rates are dependant on credit records, the amount of loan, the state of residence and other underwriting characteristics.

Loan Amounts

- Minimum: Approximately $1,000

- Maximum: $25,000

- There can be different limits on secured loans

Loan Terms

It is flexible in the terms of repayment as borrowers have a choice between 1 year (12 months) and 5 years (60 months).

Fees to Expect

- The charge on origination or administration can be based on state laws.

- The state-dependent fees associated with late payment are different.

- Very few federal pre-payment penalties.

How to Apply for a Loan?

It is easy to apply with Mariner finance:

- Go to their official Web site or a branch location.

- Create a basic application form on the Internet (lasts about 5 minutes).

- Supply-provided information (income, ID, address, SSN).

- Get soft credit check pre-qualified (no score effect).

- Send complete application (hard credit check – can impact your score).

- On approval, the funds are received through bank check or transfer.

Some loans will need a visit to a branch in order to moderate the loan to a specific amount and above.

Mariner Finance Eligibility Criteria

The eligibility requirements are:

- Minimum age of 18 or older

- Valid government-issued ID

- Social Security Number (SSN)

- Evidence of earnings and place of residence.

- Should reside in a state that Mariner works in.

Remark: Mariner Finance does not publicly reveal minimum credit score requirements. In lieu, you are approved and rated based on your general credit profile.

Prequalification vs Full Application — What You Need to Know?

Prequalification enables you to view possible loan products without having to affect your credit score. This helps in comparisons of the potential APRs.

After deciding, a complete application will be of the kind that will initiate a hard credit check, which will temporarily slacken your credit score.

Pros & Cons: A Balanced Look

Pros of Mariner Finance

- Provides loans to low and bad credit borrowers.

- Offers unsecured and secured loans.

- 15-day loan satisfaction guarantee.

- Makes cosigners empower applications.

- Reports payments to all the three major credit bureaus -can help rebuild credit

- provided that it is paid on time.

Cons & Concerns

- The APR is higher than most national internet lenders.

- Not accessible in every state of U.S.

- Certain clients complain of billing and transparency.

- Some of the states have filed legal actions accusing the unfair practices.

Customer Reviews & Reputation

Mariner Finance has ambivalent internet reviews:

- Trustpilot: To the overall positive, customers positively review the helpful staff and fast application processes.

- WalletHub and BBB: More serious tones are given with issues of customer services and loan conditions.

- Those who use third-party sites are satisfied with the level of service and other users are dissatisfied due to the high interest rates, lack of communication, or unforeseen loan expense.

In brief, the experiences differ considerably, and they are usually affected by the traits of loans as well as the expectations of the borrower.

Lawsuits, Complaints & Consumer Alerts

Lewis, Recda, and Brody (2008) note in their recent reviews and editorial coverage that there have been legal actions against Mariner Finance:

- The suits have been brought before several states claiming that they lent and sold add-on products without their explicit consent.

- There are complaints relating to unsolicited loan checks, misleading terms and claims about unfair debt practices.

These matters are indicators that one should read loan contracts keenly and seek financial counseling before taking any loans.

Benefits of Choosing Mariner Finance

Notwithstanding the fears, Mariner Finance can be useful in working with certain segments of borrowers:

Bad or Limited Credit Borrowers

In case the conventional banks reject you on a loan, the loose underwriting by Mariner can be your much needed access to a loan.

Quick Funding Needs

In most instances, approved borrowers get the funds within a few days in business.

Branch Access & Personalized Service

There are individuals who do not like an all-digital experience but would rather have the face-to-face interaction. Mariner continues to have a branch presence in the country.

Credit Building Opportunity

By making timely payments, Mariner reports to all the three major credit bureaus – this could help in raising credit scores.

Risks and Concerns

All lenders involve risk but some of the issues related to Mariner Finance are as follows:

- High APRs – This is most especially in case of unsecured loans and poor credit borrowers.

- Unpredictable Customer Experiences– There are mixed ratings on the internet.

- Potential Legal Problems – Ongoing proceedings in various jurisdictions.

Customers must never settle on a single lender and end up paying more.

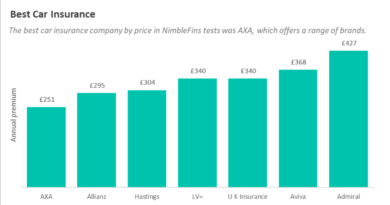

Comparison: Mariner Finance vs Other Lenders

Look at the options of personal loans when:

| Feature | Mariner Finance | National Online Lenders | Credit Unions |

|---|---|---|---|

| APR Range | 16%–35.99% | Often <10%–30% | Varies by member history |

| Credit Flexibility | Medium | High | High |

| Branch Access | Yes | Limited | Yes |

| Cosigners Allowed | Yes | Sometimes | Yes |

| Credit Reporting | Full | Full | Full |

Altogether, in case of good or excellent credit, most of the online lenders nationwide might be able to provide lower APRs and greater transparency.

Tips for Borrowers (How to Avoid Debt Traps)

- Carefully read your loan agreement.

- Enquire specifically on origination fees and late fees.

- Calculate the total interest expense using calculators.

- Compare the offers of various lenders.

- Accepting unsolicited checks without terms should be rejected.

Frequently Asked Questions (FAQs)

Q1: Is Mariner Finance legit?

A1: Yes, Mariner is a licensed lender which provides physical branches in many states in the United States and online services.

Q2: Can Mariner Finance help rebuild credit?

A2: YES – makes on-time payments to large credit agencies.

Q3: Does Mariner Finance charge prepayment penalties?

A3: No, usually, but see your loan contract.

Conclusions: Is Mariner Finance Worth It

Mariner Finance has a niche in the personal lending industry. It can be a resourceful avenue of financing to borrowers with bad or limited credit where limited sources are available. Nevertheless, increased rate of interest and diverse customer experiences require you to do due comparison shopping before you lay down money.

With the knowledge of the terms, analyzing your financial requirements, and comparing the offers of lenders, you can make a sure choice, which did not contradict your long-term plans.

Pingback: Who Is Ben Sasse? Wiki, Age, Net Worth & Trump Controversy – The World Point